I was surprised to see a tweet by @AnthonyLeeZhang that referenced a short paper showing liquidity providers (LPs) making money on Uniswap's ETH-USDC pool, as I have noted that Uniswap LPs have been losing money consistently since they began. I initially thought there was a mistake, but found his metric of PNL is ultimately identical to mine.

Specifically, he used Milionis, Moallemi, Roughgarden, and Zhang's pnl formulation, which they call Hedged LP PnL. This is the LP profit after accounting for impermanent loss (aka, loss vs. rebalancing, LvR, convexity costs).

Here, V(t) is the value of the pool's reserves. If we use the ETH-USDC pool, where p(t) is the ETH price is USDC, we getHedgedLpPnL = fees - LvR = Vt - V(t-1) - mints + burns + hedgePnL

V(t) = USDC(t) + ETH(t)*p(t)

V(t-1) = USDC(t-1) + ETH(t-1)*p(t-1)

The difference in the value of reserves is affected by the price change and the changes in USDC and ETH that come from mints (LP deposits), burns (LP withdrawals), trades, and fees. The ETH and USDC coming into the pool contain both fees and the tokens traders sell (swap into the pool), so this implies

USDC(t)=USDC(t-1) + mints(t, t-1) - burn(t, t-1) + NetUsdcIn(t, t-1)

ETH(t) = ETH(t-1) + mints(t, t-1) + burns(t, t-1) + NetEthIn(t, t-1)

[note: (t, t-1) is the flow in the period from t-1 to t]. This reduces to just valuing the pool's net USDC and ETH reflected in trader swap event logs, valued at the end of the period. There is a slight difference created by ignoring the prices when mints and burns happen, but both approaches make assumptions that make these PnL calculations approximations, and the differences are insignificant. I prefer this formulation because it requires less data.

Hedged LPpnl = NetUsdcIn(t, t-1) + NetEthIn(t, t-1)*p(t)

While one can use periods of arbitrary duration, in the limit, it does not matter, and as a practical matter, pulling this by calendar day works well for seeing trends, as well as avoiding trading costs if one were to actually hedge their LP pool position.

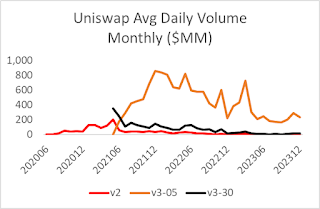

More importantly, this introduced me to the fact that Uniswap's v2, the old capital-inefficient automated market maker (AMM), makes money for its LPs. I figured it was obviously worse in every way, which is why its flagship ETH-USDC 30bp fee (basis points, 0.3%) pool has about 2% of the volume of the ETH-USDC 5bp v3 pool, which is about half of the unpopular 30bp v3 pool.

|

| ETH-USDC pools |

|

| Uniswap v2 ETH-USDC pool |

|

| ETH-USDC pools |

liquidity = sqrt(USDCinPool * ETHinPool)

Applying AMM math, we get

return% = 2 * DUSDC/(liquidity * sqrt(p))

DUSDC(from arbs) = 0.85 * liquidity * sqrt(p) / 2

We see that for the v3 5 bp pool, volume/liquidity has been 2.5 times higher than in the v2 pool, far lower than the 6 times it needs. In the v3 30bp pool, the ratio is about 50% of the v2 pool. The flagship AMM for the flagship dapp on the flagship blockchain has been and continues to be a loser. This is an existential problem for AMMs because large users are constrained to centralized exchanges without a sustainable, liquid AMM. These centralized exchanges are necessary but cannot be essential for large trades if crypto is to avoid outside attacks by the institutions that control the major fiat currencies.

|

| ETH-USDC pools |

With the v2 pool, there is one common cost for the LPs they all can intuit: capital. Every LP is treated pro-rata based on their stake in the AMM's pool. In contrast, many v3 LPs think that they get ahead of their fellow LPs by concentrating their liquidity in a narrow band or adjusting their ranges based on current volatility. The effect of extra liquidity never occurs to them. The end result is a persistent excess of liquidity that does not just dilute profits; it turns them into losses. The greater the liquidity, the greater the convexity cost, which, unlike merely adding shares to a stock, affects the sign of net income.

Many have written about how adding money to a v3 pool is obviously a better strategy than LPing for a v2 pool because by restricting a range to a generous 20% up and down, they could deploy the same amount of liquidity with only 8% of the capital they would need for a v2 pool. They never considered the consequences if everyone else came to the same conclusion, leading to an excess of liquidity that is linearly related to the pool's convexity cost. As most people do not understand, let alone measure, convexity costs, they blithely deposit capital into these pools, ignorant of the equilibrium effect on costs that affect their bottom line.

No comments:

Post a Comment