I disagree. As I've mentioned, even Robert Shiller's 2005 updated edition to Irrational Exuberance contained a very cautious look about housing. He noted it rose a lot recently, and such a rise was improbable going forward. But he did not say an aggregate price decline was likely or even significantly probable.

In that vein, the price-earnings ratio is a good example of a metric that seems very useful, but in practice not. Robert Shiller keeps historical data for the US back to 1871 on his website. You can see that P/E ratios vary over the cycle in what appears to be very predictable fashion.

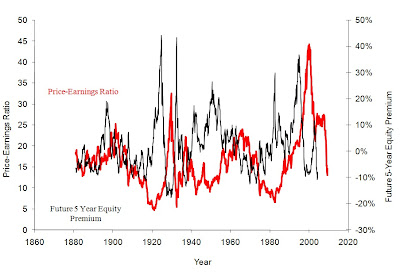

The above graph shows the P/E ratio as well as the future 5 year equity premium, which I defined as the annualized future 5 year stock return minus the average Long Term Treasury bond yield. There's a nice negative correlation between this future return and current P/E ratios (Shiller uses the prior 10 years earnings for his denominator). One thinks, hey, this is a pretty obvious investing signal.

Yet, on a monthly level, the signal is horrible. If you look at the current P/E, and compare this to the then historical data, there's a very small relation with month-ahead returns. Given the upward drift in the stock market over time, and rule based on historal P/Es, where you choose to invest/not-invest based on, say, being in the 90th percentile of P/Es, lowers your annual return.

But, the correlation on a longer basis seems much better, and so, if you chose a rule to say, invest/not-invest every 5 years come hell-or-high-water, this surely generates a much better return? No. One way to see this is the graph below. Here I calculated the ratio of the earnings yield to the Treasury rate(earnings/price normalized by the interest rate as represented by the long term Treasury rate). One sees a very tight relation from 1920 through 1960, perhaps even to 1980, but you would have missed the bull run of the 1890's and 1980-2000. Any rule here, over the entire century, generates no real gain.

The bottom line is that many trends that seem really good, work over long periods of time, but for only half the time. In an up-trending market, anything that tempts you to sit on the sidelines is swimming against the stream. For assets that historically have trended upward, like housing or stocks, it is never obvious when to move totally out of the position.

5 comments:

Despite the well-documented difficulties in finding good trading rules - even with lots of degrees of freedom for hindsight data mining - I still (irrationally?) feel that if you buy stocks when they are cheap with respect to earnings that is a better deal than if you buy them when they are expensive.

Good information, thanks.

As a quick sidenote, can't you just use technical analysis to determine the current trend, and stick with that?

A simple rule such as, buy when the 6 month exponential moving average is above the 9 months exponential moving average, and sell when the 6 month moves below the 9 month should work in terms of timing the long term trend, while still being minimal effort.

You say this recent dust-up wasn't predictable. Yet you don't like Taleb's Black Swan idea. So what kind of event was it?

Interesting article.

My personal experience: I was able to use the Shiller data (when the book came out) to slightly trim my personal exposure to equities and improve the performance in 2000-2003. (I never seriously considered getting entirely out of the market for the reasons you mention). But this time (2006) I did not take any action, partly because I thought the professor was becoming a consistent bear, and I did not see this crash coming.

So, yes, I have found it is difficult to make use of this type of information.

cash is what matters.

those that have it can do advantageous things no matter what point we are at in a cycle.

but even cash is not as valuable as the natural resources themselves.

cash can be rendered "worthless".

how much can you do with small pieces of paper?

however there are few, if any, limitless natural resources needed for human survival- these resources will always have value to people trying to survive.

all that being true, there's also one (intangible) thing that can be as valuable as either cash or natural resources:

the power to persuade.

for instance, i can persuade people i know something they don't know but need to know, and should know, i might be able to convince them to exchange their cash or resources for my knowledge. i could persuade the that life is very complex and that before thy act, they need more information than they have available to them.

i could refer to my knowledge as in the field of "economics".

or, i could even persuade people to give me resources directly, just because they want my companionship. otherwise known as "sharing".

Post a Comment