Black-Scholes is perhaps the most famous equation in finance. It was originally derived by Fischer Black and Myron Scholes by using arbitrage to create a partial differential equation, which turned out to be the well-known heat equation from physics. Solving differential equations is hard, for me anyway (it doesn't come up a lot, so like my French, je sais un peu). Cox and Rubinstein showed how to use a binomial model to prove risk neutrality, and that proof is a lot easier. From there you can derive the result in a relatively simple way.

So we start with just two assumptions

1) The underlying asset follows a lognormal random walk

2) Arbitrage arguments allow us to use a risk-neural valuation approach (Cox-Rubinstein's proof is easiest here), discounting the expected payoff of the option at expiration by the riskless rate and assuming the underlying's return is the risk free rate

Derivation of Black-Scholes for a European call option c with strike K, discount rate r, on stock S, with time to maturity t, and expectations operator E.

Equation 1: The definition of a call option

Equation 4: substitute into R an exponential and its normal distribution, where f(u) is the normal density function with a mean of μt=(ln(r)- ½ σ2)t and volatility σ√t

So we start with just two assumptions

1) The underlying asset follows a lognormal random walk

2) Arbitrage arguments allow us to use a risk-neural valuation approach (Cox-Rubinstein's proof is easiest here), discounting the expected payoff of the option at expiration by the riskless rate and assuming the underlying's return is the risk free rate

Derivation of Black-Scholes for a European call option c with strike K, discount rate r, on stock S, with time to maturity t, and expectations operator E.

Equation 1: The definition of a call option

Equation 2: End of period stock price as a function of its return by definition, where R is the gross rate of return

Equation 3: rewriting eq(1) in integral form, where h() is the lognormal density function, and labeling S(0) as simply S, (note K and k are the same below, I'm too lazy to change them)

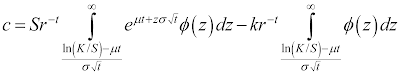

Equation 5: substituting for u now using a change in variables to z we have

Equation 6: rearranging

Equation 7: substitute (ln(r)- ½ σ2) for μ and factor out eln(r)t

Equation 8: multiply the normal density by the exponent

Equation 9: factor exponent

Equation 10: make substitution zhat=z-σ√t

Equation 11: rearrange integral bound

Equation 12: using the fact that

we can switch and negate the integral bounds

Equation 13: using algebra we then get

Equation 14: rewrite in Normal Cumulative Density notation to get the familiar Black-Scholes equation

where

QED

6 comments:

There is also what I like to call "the French way", which is actually a probabilistic approach to solving the equation. It might seem pedantic but is quite short and gives physical and meaningfull insight to the terms of the equation :

C = discount * E[(S-K)+] = discount * E[(S-K) * 1(Exercise)]

Let's split the S and K terms :

C = discount * (E[S*1(exercise)] - K * E[1(Exercise)])

Where expectations are taken under the Q probability.

The second term is easy

E[1(Exercise)] = Q(exercise) = N(d-)

where d- = (ln(F/K) - sigma² * T/2)/sigma/sqrt(T)

where F is the forward price.

I really do prefer ln(F/K) to ln(S(0)/K)+rT since we understand where the r comes from, and it easy to adapt the formula to dividends, repo, funding conditions, ... This 'r' is essentially different from the one in the discount term, which is related to the heger funding. The 'r' in d+/- is the risk neutral drift of the spot price.

Let work on the first term, slightly more difficult : E[S*1(exercise)]

Using a change of numéraire, we can choose S itself as numeraire, and Q(s) the associated measure. Then :

E(Q) [S(T)*1(exercise)] = F. E(Qs)[ 1(exercise)] = F.Qs(exercise)

Where F is the forward. Usig Girsanov theorem, under Qs the drift of S is r+sigma²/2, hence :

Qs(exercise) = N(d+)

Where d+ = (ln(F/K) + sigma² * T/2)/sigma/sqrt(T)

So now we can write that :

C = discount *(F * N(d+) – K N(d-))

d+/- = (ln(F/K) +/- sigma² * T/2)/sigma/sqrt(T)

Stephane: It isn't obvious that

E[1(Exercise)] = Q(exercise) = N(d-)

d- = (ln(F/K) - sigma² * T/2)/sigma/sqrt(T)

Ed Thorpe was generous enough to teach one of these two eggheads how it was done, they then spit shined it with the requisite academic anti-realism varnish, and became famous for it.

Ed did figure out the basic formula, but he didn't have the risk-neutrality point, if I'm not mistaken. More importantly, Ed hasn't suffered too much, he's done quite well.

Eric,

I never cared for the risk neutral version of this proof. If you assume log-normal with mean mu then you can use it to get the expected value of both the stock and call option in terms of mu:

stock = f(mu)

call = g(mu)

Then use the first of these to eliminate the mu in the second. Thus the call is a function of the stock price and not mu.

Post a Comment