A lot of people find Pandit's pay extremely annoying as if Pandit is taking their money, but unlike government money, this is other people wasting their own money. Sure, Citi was backstopped in the bailout, but 1) they couldn't have refused it 2) they paid it all back and 3) that's not a reason to regulate Citi more, rather, to not bailout big banks. The solution to bad regulation isn't more regulation, but less. It's not only creates more efficient incentives and allocation of risk and capital, but is far easier to implemented.

For example, the latest regulatory proposal actually targets spreadsheets:

The regulator stated that insurance firms will be expected to demonstrate appropriate controls with regard to key internal data flow systems such as spreadsheets. These controls should take the form of, among others, input validations, change and release management, disaster recovery and documentation.They might as well validate my Post-it notes too.

Back to Citi, I think the best way to increase value there is to break it up into into manageable pieces. One simply can't manage something that big, as the big banks are demonstrating.

9 comments:

Re: regulating spreadsheets: I think a lot of this is just public choice theory—you give someone a job writing regulations, he’s going to think up new ones for as long as he has the job. It’s like U.N.’s goal of perpetuating wars at all costs. You can’t have peace processes without wars, after all…

Under a break-up scenario, will total CEO and board compensation go

A) up

B) down

I'm guessing A), once you spread it over all the new CEOs and boards. If you look at small companies, CEO and board compensation can be more than half the profits. At large companies like Citi, CEO compensation per dollar of revenue is actually pretty small.

Yes, and don't forget all the money he received for his failed hedge fund. Why this guy was chosen to be CEO is the real question.

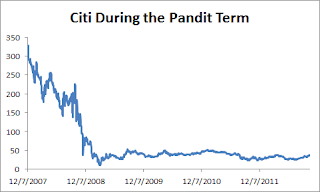

Is it fair to credit Pandit with the stock price failure?

The positions that blew up Citi where legacy positions before he became CEO that the market hadn't realized how shitty they were.

Surely it's not all his fault, but the weak bounce is...and the solution is rather simple.

In a recent project, among other things, I put some key spreadsheets under version control. Now changes to formulas and VBA code are tracked and annotated. We leave changes to data untracked. This was helpful for answering questions like, "what is the difference between these different versions of the spreadsheet? Which version should I be using? Did we implement X? When did we do that? When was this error introduced?" Version control for spreadsheets is not as straightforward as it is for text-only software source code, but it can still be done. I guess if regulators are pushing for this, I might be seeing more of this kind of work. I hope you (Eric) don't mind if I put a little ad here:

If you need help using version control systems with spreadsheets, e-mail spreadsheetversioncontrol@yahoo.com

According to Sheila Bair, Pandit was chosen to appease Bob Rubin (http://finance.fortune.cnn.com/2012/10/16/sheila-bair-im-sure-vikram-still-blames-me/). He probably easily beats out Pandit for optimal extraction of a big inefficient corporation. All these ex-GS bigwigs, they can't just buy their island and live happily ever after. They have to destroy companies and economies as their incentive structures are such that they are only interested in taking as much risk as they are allowed. (eg. Rubin-citigroup, Corzine - MF global, Kraus - AllianceBernstein etc.)

The gnumeric spreadsheet offers a preference to set compression to 0, and it will output an XML file that is *MOSTLY* line oriented (each cell for example is saved as one line of text), so it plays nice with text-oriented version control systems (like git, etc). Presuming multiple users of the versioning system play nice with each other (tracking branches, and merging, etc) you can do OK.

If you move big chunks of cells around then the version controller generally flags every moved cell as a change, making it difficult to identify what has happened. A bit of common sense is necessary.

There's a bit more to it than just version control. There's been a long battle between core business IT systems designers and individuals on the periphery who decide the core system doesn't perform the way they want (and often requests for improvement fall on deaf ears) so they just use a spreadsheet and ignore the main company business systems. Worse is the loss of face for high power managers when some corner of the company run by a handful of guys with spreadsheets actually outperforms the core system (in particular niche areas, which are the reason why spreadsheets are so great in the first place).

The regulators will never win this one, the more you take tools away from people the more creative they are about finding alternatives.

In response to "The regulators will never win this one, the more you take tools away from people the more creative they are about finding alternatives," I'd like to point out that in putting spreadsheets under version control, one is providing people with additional tools for managing and tracking changes rather than taking tools away. Of course, they can choose not to use these additional tools - they can make changes to spreadsheets outside of version control and can refuse to commit their changes.

My guess is that many organizations will put some key spreadsheets under version control and show these to regulators, but then leave a lot of other key spreadsheets outside of version control. But, if this means going from none to some, it is still a step forward.

We can say similar things about input validation. One can write code to validate certain cells, but users can choose to use other cells or might even delete the validation code. Some users might do that, but others might actually prefer using validated inputs.

Post a Comment